glenwood springs colorado sales tax rate

The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is. Sales tax rates in Garfield County are determined by eight different tax jurisdictions Silt Rifle De Beque Parachute New Castle Garfield Glenwood Springs and Glenwood Sprgs Roaring Fork Rta.

Colorado Sales Tax Rates By City County 2022

1 day agoAfter rebounding from the pandemic in 2021 Glenwood Springs is still showing growth in sales tax revenue.

. City Hall 101 W 8th Street Glenwood Springs CO 81601 Phone. Automating sales tax compliance can. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date.

Above taxes plus City Accommodation Tax. 307 City of Colorado Springs self-collected 200 General Fund 010 Trails Open Space and Parks TOPS. 6 rows The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state.

The estimated 2022 sales tax rate for 81601 is. The Colorado sales tax rate is currently. This system allows businesses to access their accounts and submit tax returns and payments online.

Gleneagle CO Sales Tax Rate. Access the MUNIRevs System. The County sales tax rate is.

This is the total of state county and city sales tax rates. The Glenwood sales tax rate is 37. The combined amount is 820 broken out as follows.

The City of Glenwood Springs has partnered with MUNIRevs to provide an online business licensing and tax collection system. Has impacted many state nexus laws and sales tax collection requirements. City Hall 101 W 8th Street Glenwood Springs CO 81601 Phone.

Through June and up to date were up something like 7 against 2021 sales tax across the whole city. Glenwood Springs is located within Garfield County Colorado. Goldfield CO Sales Tax Rate.

Ad Find Out Sales Tax Rates For Free. Within Glenwood Springs there are around 2 zip codes with the most populous zip code being 81601. Gold Hill CO Sales Tax Rate.

Grand Lake CO Sales Tax Rate. The average cumulative sales tax rate in Glenwood Springs Colorado is 86. Sales Tax Rates in the City of Glenwood Springs.

The County sales tax rate is 1. Effective with January 2014 sales tax return the penalty interest rate has changed to 05. The sales tax rate does not vary based on zip code.

What is the sales tax rate in Glenwood Springs Colorado. To tal Tax rate with Accommodation Tax. Golden CO Sales Tax Rate.

Did South Dakota v. Download our Colorado sales tax database. Grand Junction CO Sales Tax Rate.

4 rows Glenwood Springs CO Sales Tax Rate The current total local sales tax rate in Glenwood. 1110 These taxes are sent to the State of Colorado. Granada CO Sales Tax Rate.

This includes the sales tax rates on the state county city and special levels. Granby CO Sales Tax Rate. To review these changes visit our state-by-state guide.

The 2018 United States Supreme Court decision in South Dakota v. Did South Dakota v. The Glenwood Springs sales tax rate is.

13 rows Sales Tax Rates in the City of Glenwood Springs. Wayfair Inc affect Colorado. State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood Springs 370 Total.

Revenue is up and not too. Water Sewer Improvement. The 2018 United States Supreme Court decision in South Dakota v.

I would say that 2022 is likely to establish a new base said Steve Boyd acting city manager. Has impacted many state nexus laws and sales tax collection requirements. The Colorado sales tax rate is currently 29.

Fast Easy Tax Solutions. The 86 sales tax rate in Glenwood Springs consists of 29 Colorado state sales. What is the sales tax rate for the 81601 ZIP Code.

The Glenwood Springs Colorado sales tax is 290 the same as the Colorado state. Up to 20 of City-imposed sales taxes which can be applied against fees costs and tax. Business is located in Glenwood Springs.

Garfield County Colorado has a maximum sales tax rate of 86 and an approximate population of 37765. Glenwood Springs CO Sales Tax Rate.

Utah Sales Tax Rates By City County 2022

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Colorado Sales Tax Rates By City

Washington Sales Tax Rates By City County 2022

Marijuana Sales Tax Department Of Revenue Taxation

Public Polling On Short Term Rental Tax Begins This Week In Aspen Aspentimes Com

Georgia Sales Tax Rates By City County 2022

Alabama Sales Tax Rates By City County 2022

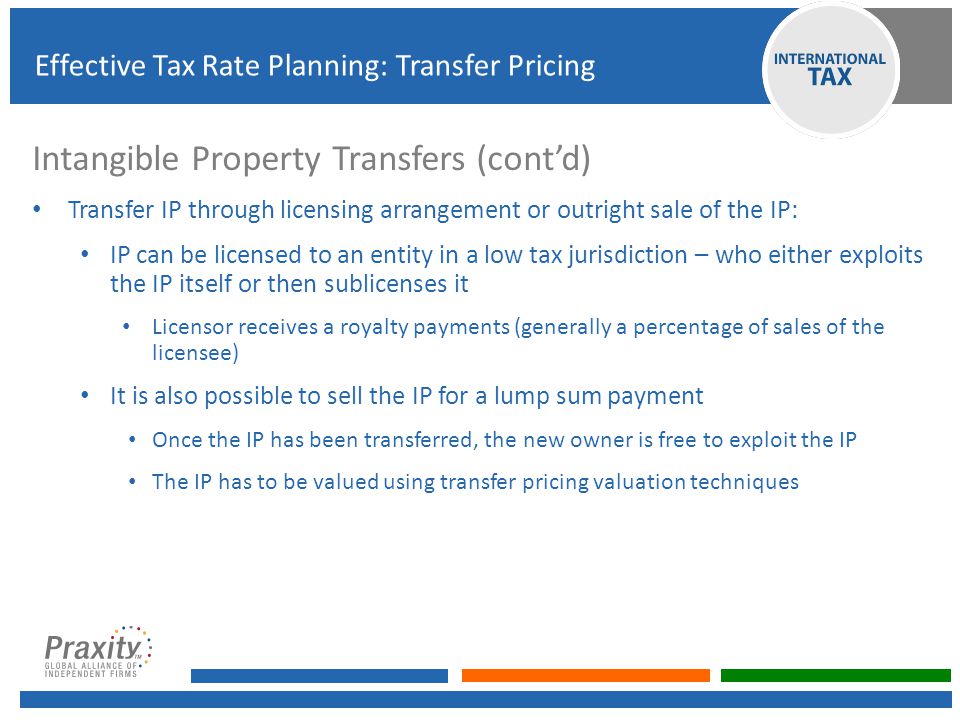

From Principles To Planning Ppt Download

Renters Swarming Colorado Mountain City At 6th Highest Rate In Nation Newsbreak