child tax credit payments continue in 2022

The maximum child tax credit amount will decrease in 2022. Those returns would have information like income filing status and how many children are.

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

October 6 2022 809 AM CBS Los Angeles.

. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400. Those returns would have information like income filing status and how many children are. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

The advance child tax credit payments were based on 2019 or 2020 tax returns on file. An expanded child tax credit would continue for another year. Now even before those monthly child tax credit advances run out the final two payments come on Nov.

Time is running out to claim the expanded Child Tax Credit that could bring an eligible family as much as 3600 per. Those returns would have information like income filing status and how many children are. The benefit for the 2021 year is 3000 and 3600 for children under.

The advance child tax credit payments were based on 2019 or 2020 tax returns on file. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. The advance child tax credit payments were based on 2019 or 2020 tax returns on file.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. As part of a COVID relief bill Democrats increased the tax credit to 3000 per child ages 6-17 and. 15 Democratic leaders in Congress are working to.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

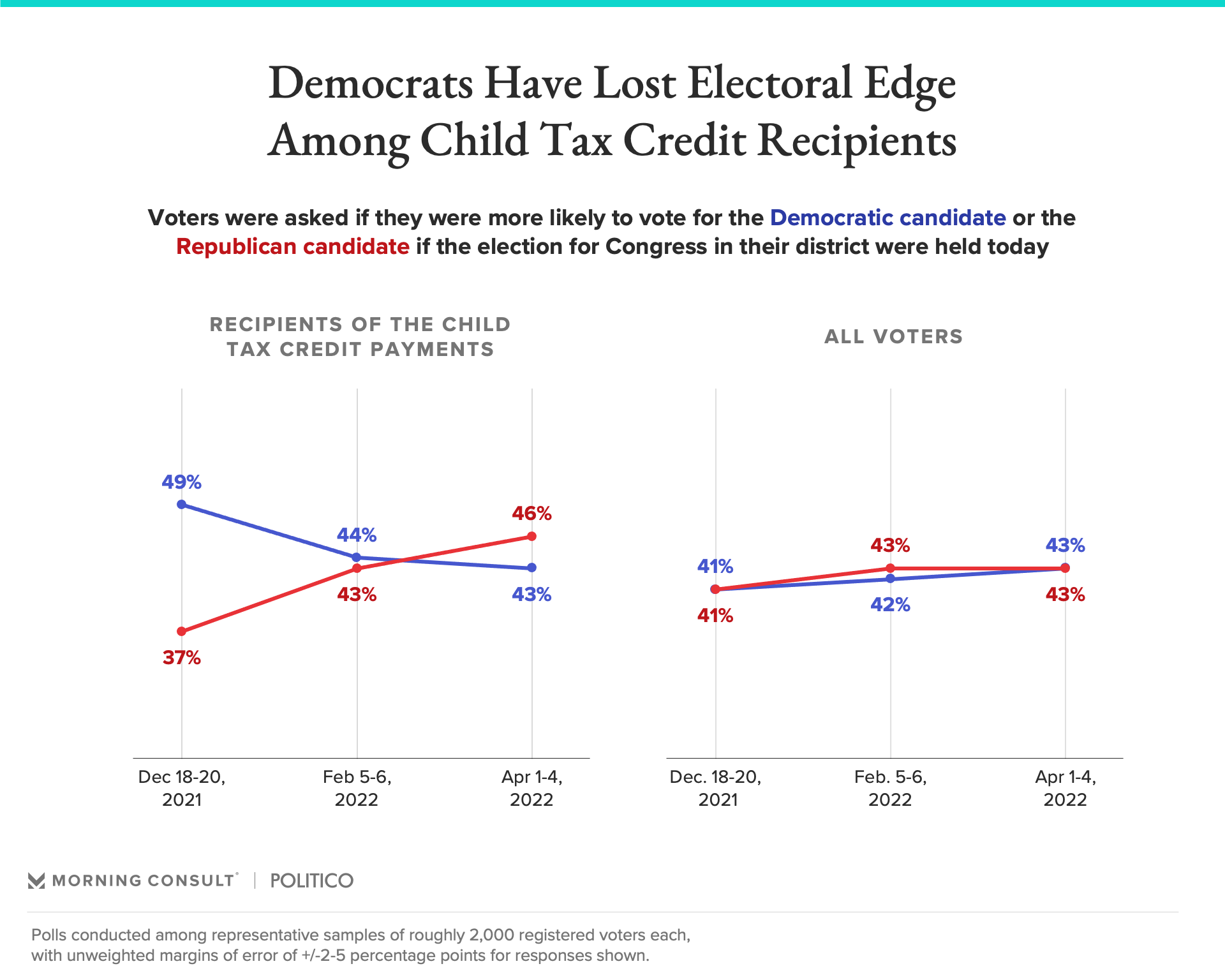

Republicans Favored To Win Senate Among Child Tax Credit Recipients

Will Monthly Child Tax Credit Payments Continue In 2022 Their Future Rests On Biden S Build Back Better Bill

Child Tax Credits Worth Up To 600 And 900 Could Be Sent To Parents In 2022 As Payments Might Double The Us Sun

Child Tax Credit Money In 2022 Irs Letter Helps File Returns For More

Child Tax Credit Will Monthly Payments Continue In 2022 11alive Com

Will The Monthly Child Tax Credit Payment Be Extended Next Year The Us Sun

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Families Need To Know About The Ctc In 2022 Clasp

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

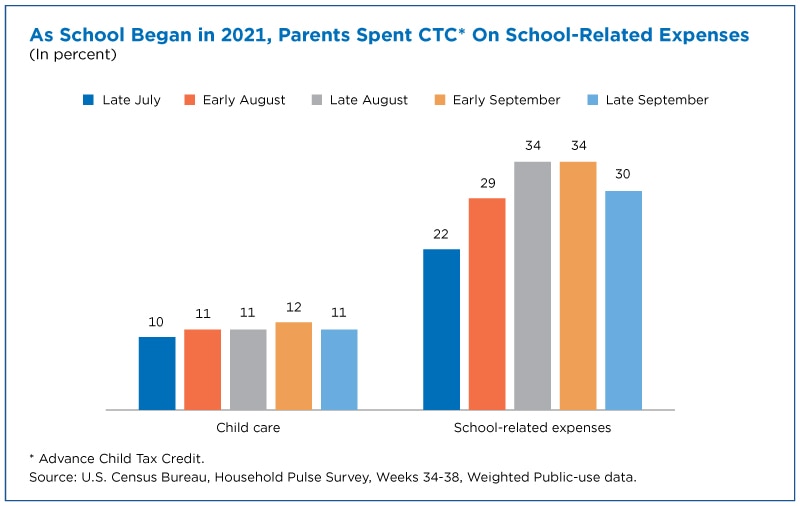

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Families Won T See Child Tax Credit Payments For First Time In Six Months

Monthly Child Tax Credit Payments Have Ended And Their Future Is Unclear

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times